New Economy of Tennessee Fund

(NET Fund)

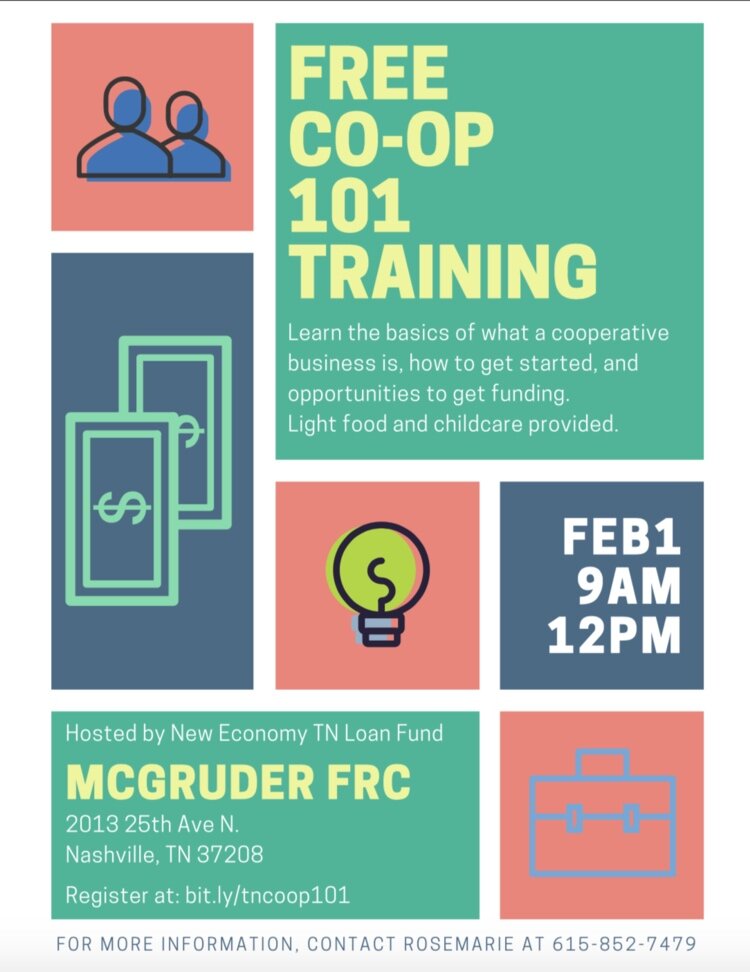

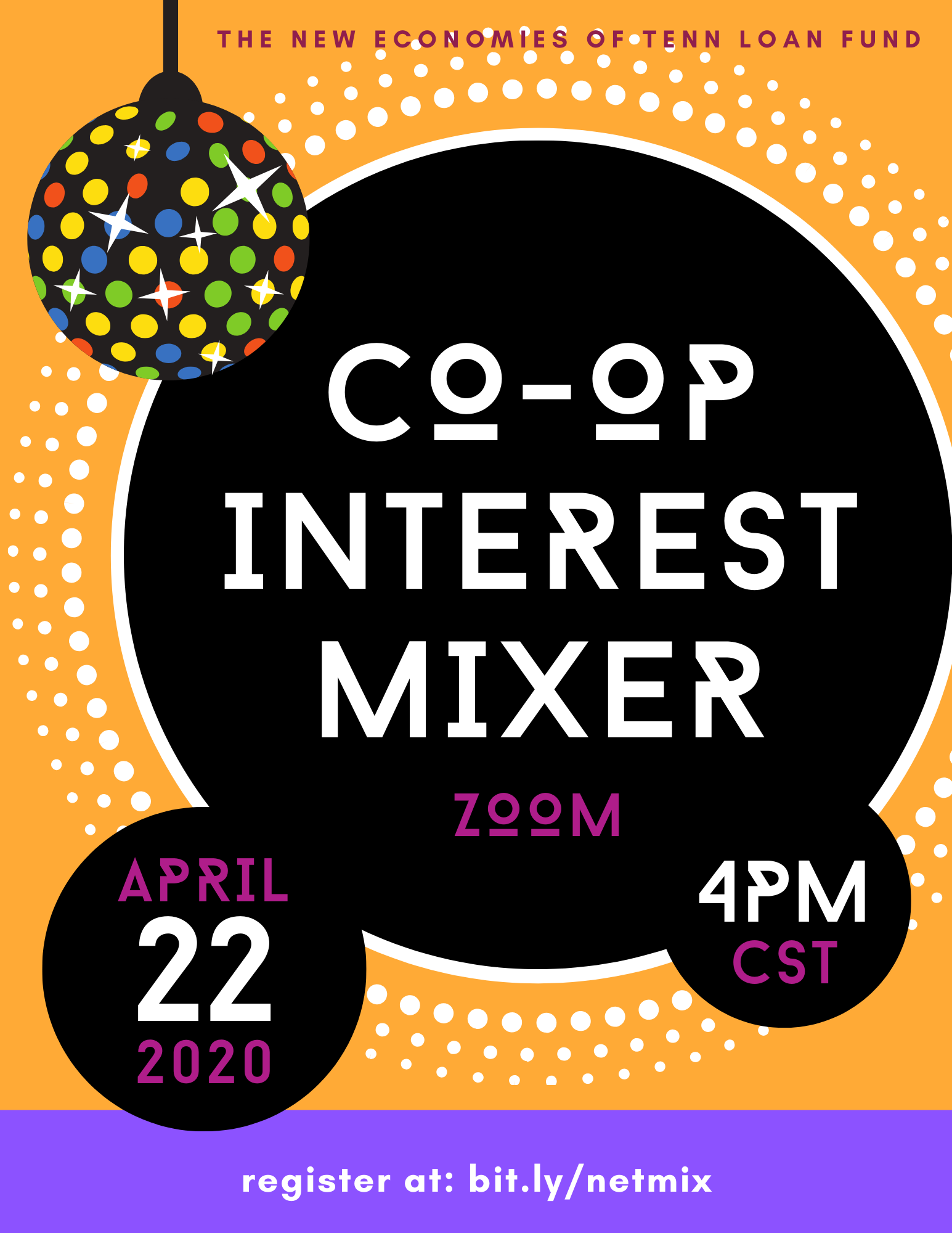

In the spring of 2019 the Southeast Center for Cooperative Development and Free Hearts, an organization led by formerly incarcerated women, providing support, education, and advocacy to families impacted by incarceration as it pursues opportunities to create jobs, training and financial support for individuals reentering, formed an alliance to create a local non-extractive loan fund to support minority worker cooperatives start-ups and conversions.

This loan fund, the New Economy of Tennessee Fund (NET Fund), is part of Seed Commons, a community wealth cooperative that shares capital and resources to support local cooperative businesses create jobs, build collective economic power, and wealth for people of color, formerly incarcerated individuals, immigrants, and others who must overcome great barriers to participate in the economy.

Aprender más acerca de Seed Commons en Español:

The unique aspect of a non-extractive loan fund is that the returns to the lender never exceed the wealth created by the borrower. For the cooperative this means that a loan with a Seed Commons peer fund will actually benefit the borrower following these common non-extractive terms:

· No repayments greater than profits: Borrowers are not required to make interest or principal repayments until they are able to cover operating costs, including market-rate salaries;

· No personal guarantees: Financing agreements never use assets for security unless the asset has been purchased with the financing agreement proceeds;

· No credit scores: Instead of credit scores, Seed Commons uses close relationships between local loan officers and potential loan recipients to establish a borrower’s reliability.

Seed Commons and the NET Fund aim to bring ownership and wealth based on democratic principles and capital that is subordinate to the needs of people and to the community.

If you are interested in learning more about this loan fund for cooperatives, please fill out this intake form HERE and submit.

CHECK OUT OUR BLOG ENTRY HERE.

Emergency Relief Fund

For small Nashville minority-owned businesses impacted by COVID-19 and/or the March 5 Tornado

Creation of the Emergency Relief Fund

After a devastating tornado hit Middle Tennessee on March 3, 2020, over 400 commercial buildings were damaged with at least 20 salons and barber shops shuttered in the North Nashville area alone. The next week, the COVID-19 pandemic hit with the closing of non-essential businesses.

The NET Fund committee met with business owners of the most affected areas of Metro Nashville whose residents are predominantly people of color to talk about the impact of the catastrophes on their businesses. We sought to learn what types of support are needed to keep businesses going, and about their access to emergency funding by government agencies, public and private orgs, foundations, banks, etc.

We learned that recovering from these catastrophes has been extremely difficult especially for small businesses owned by people of color in North Nashville. Today, there is still much uncertainty around how and how quickly the economy will improve. Through our discussions three main tasks have become evident to support local small minority-owned businesses: providing immediate relief, helping businesses pivot if necessary, and tackling systemic problems the pandemic brought to light.

As many small businesses fight for survival, we see the need to expand the work of the NET Fund and start an emergency fund to support minority small businesses owners impacted by recent catastrophes. With emergency relief funds we can help keep businesses open and help preserve North Nashville’s unique community personality and character.

Our goal is to raise $25,000 for the creation of the fund and to award 10 minority-owned businesses each a $2,500 grant. We anticipate raising $15,000 through foundation funding and aim to supplement this amount with a crowdfunding campaign via GiveLively. Our fundraising objective throughout the month of October is to raise the remaining $10,000.

We have created an application process which will be used to initially select 2 grantees. We will review the process for improvements and then begin the next round of funding. We anticipate a great and immediate need and will proceed until the grant funds are depleted. Our selection criteria include the minority status of small business owner, need, number of employees, and intended use of funds.

This first wave of COVID-19 infections is likely not to be the last; so, building this Emergency Fund will be important over the coming year. Donations from the community and cooperative supports will make a critical difference for business owners excluded from other sources of recovery funds.

CHECK OUT OUR BLOG ENTRY HERE.